Comment mettre votre entreprise en conformité avec la nouvelle norme de reporting extra-financier : la Corporate Sustainability Reporting Directive1 ?

Qu’est-ce que la Corporate Sustainability Reporting Directive (CSRD) ?

La CSRD est la nouvelle réglementation européenne qui définit les normes d’information à publier par les entreprises privées en matière de durabilité. Elle remplacera l’ancienne réglementation (Non Financial Reporting Directive ou NFRD) et sera transposée en droit français d’ici au 1er janvier 2024.

Déterminer la démarche de votre entreprise : mise en conformité obligatoire ou volontaire ?

Toutes les entreprises anciennement soumises à la NFRD, traduite en droit français par la publication d’une Déclaration de Performance Extra-Financière (DPEF), doivent se mettre en conformité avec la nouvelle réglementation. La CSRD modifie et comble les lacunes de l’ancien dispositif (absence de normes communes pour les entreprises obligées, absence de standardisation des déclarations, difficultés à comparer les performances ESG), encore en vigueur pour l’exercice 2023. La CSRD élargit le champ d’application de reporting extra-financier aux Petite ou Moyenne entreprise (PME) européennes et non-européennes cotées, et aux entreprises cotées non-européennes.

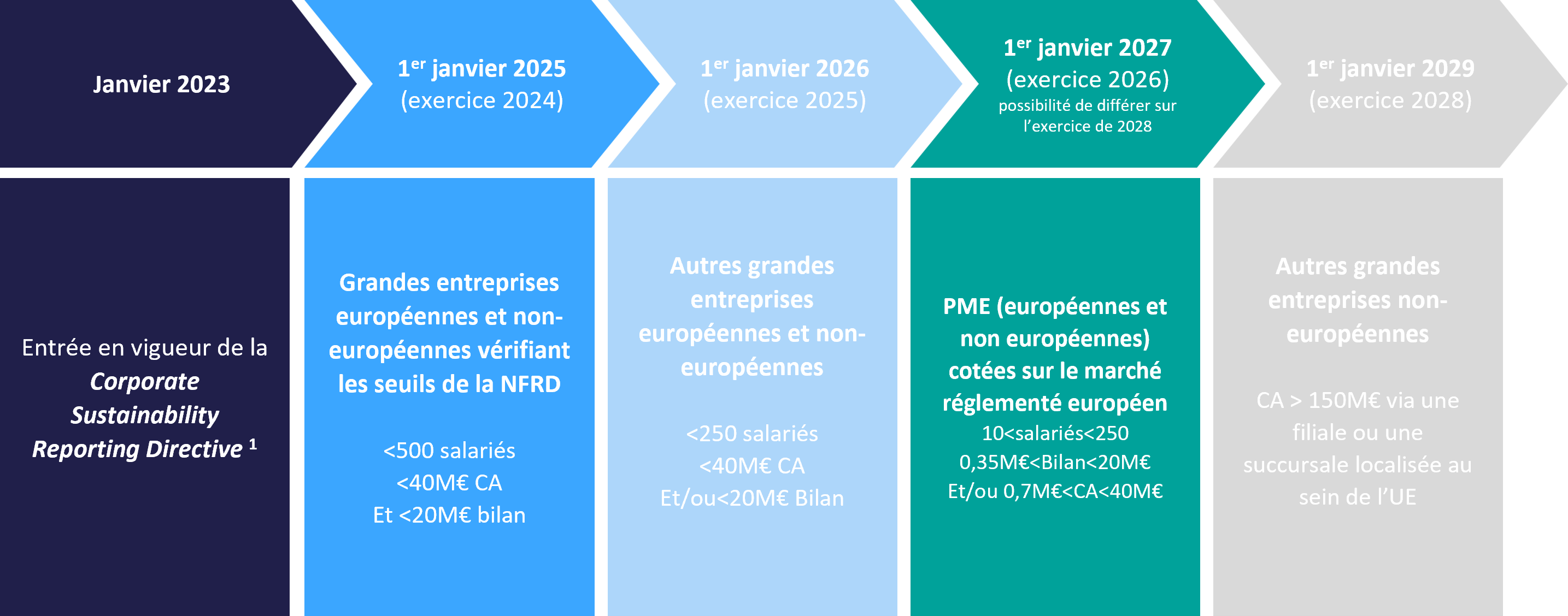

Les obligations s’appliqueront progressivement aux entreprises à compter du 1er janvier 2024 :

Doc1. Calendrier d’application progressive de l’obligation de reporting extra-financier à compter de janvier 2024

En quoi consiste le reporting extra-financier des entreprises concernées par la CSRD ?

L’obligation de reporting extra-financier prévue par la CSRD comporte deux avancées importantes. Toutes les entreprises sont soumises à l’obligation de réaliser « une analyse de la double matérialité »2 pour déterminer les informations « matérielles » qui devront apparaître dans le rapport final (1). Par ailleurs, la CSRD précise les thématiques (et sous-thématiques) que l’analyse devra couvrir, ainsi que les informations (sous formes « d’exigences de publication ») qui devront être publiées à l’issue de l’analyse, dans le rapport de durabilité (2).

(1) Harmonisation de la méthodologie à suivre : l’analyse de la double matérialité

L’analyse de la double matérialité est le pilier central de la CSRD3. D’un côté, l’entreprise identifie et analyse les incidences, les risques et les opportunités (IRO) d’une thématique ESG sur la performance financière de l’entreprise (les résultats, les flux de trésorerie, le coût du capital etc.) : c’est la matérialité financière. De l’autre, l’entreprise identifie et analyse les incidences (positives, négatives, réelles ou potentielles) des activités économiques de l’entreprise et de sa chaîne de valeur sur l’environnement et la population/ société : c’est la matérialité d’impact.

Toutes les entreprises obligées devront justifier des seuils quantitatifs et qualitatifs pertinents pour identifier les IRO comme « matériels » ou non.

Le législateur européen a commissionné l’organe européen consultatif en matière de normes internationales d’informations financières, le European Financial Reporting Advisory Group (EFRAG), de publier des guidelines pour standardiser la réalisation de l’analyse de double matérialité4.

(2) La standardisation des indicateurs / normes de reporting

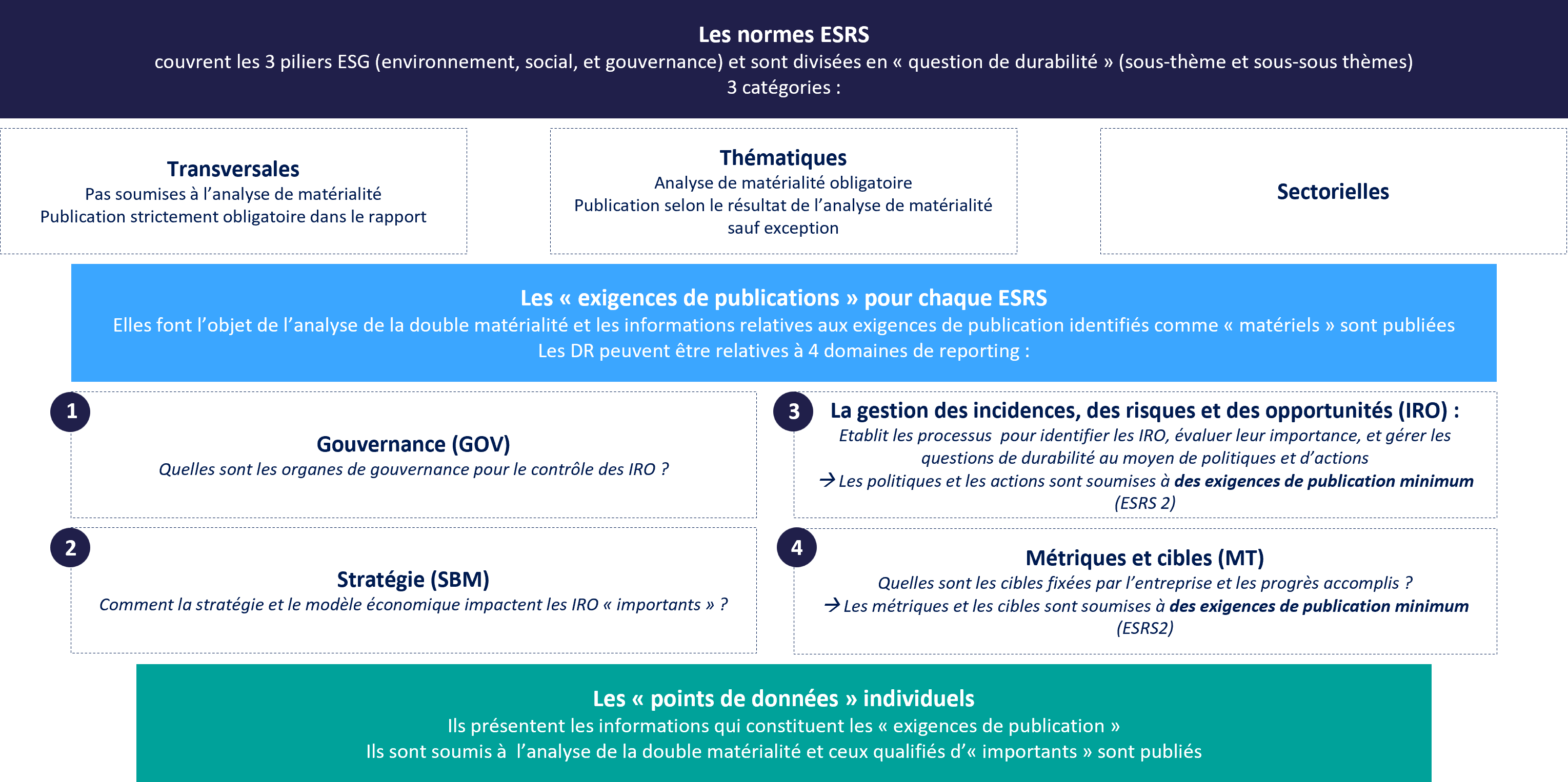

La CSRD prévoit deux types d’indicateurs : des normes générales et thématiques d’information en matière de durabilité (les « European Sustainability Reporting Standards » ou ESRS5) et des « exigences de publication » (« Disclosure Requirement » ou DR). Ces indicateurs uniformisés facilitent la comparaison des performances ESG des entreprises.

Les ESRS : les normes générales et thématiques

La CSRD publie 12 « normes européennes d’information en matière de durabilité ». Chaque norme est décomposée en sous-thèmes (ou « questions de durabilité ») soumis à l’analyse de matérialité. Pour chaque sous-thème couvert par une ESRS, l’analyse identifie les IRO « matériels » pour l’activité de l’obligé.

Il existe 3 catégories d’ESRS :

- Les normes transversales (2) dont la norme ESRS 2 Informations générales à publier qui s’appliquent à toutes les questions de durabilité couvertes par les 10 normes thématiques et sectorielles, et dont la publication dans le rapport est strictement obligatoire ;

- Les normes thématiques (10) qui recoupent les 3 piliers de la RSE et qui sont sujets à l’analyse de la double matérialité ;

- Les ESRS sectorielles qui recouvrent les normes insuffisamment ou non couvertes par les normes précédentes, et importantes pour toutes les entreprises d’un secteur spécifique.

Les exigences de publication

Chaque thématique ESRS comprend par ailleurs des « exigences de publication ». En fonction des résultats de l’analyse de matérialité et des seuils fixés par l’obligé, ce dernier publie dans son rapport les informations relatives à « l’exigence de publication » identifiée comme « matérielle ».

Ces exigences par thématique peuvent recouper 4 différents domaines d’informations indépendants les uns des autres : Gouvernance (GOV), Stratégie (SBM), Gestion des incidences, des risques et des opportunités (IRO) et Métriques et cibles (MT). Ces quatre domaines sont décrits par la norme « ESRS 1 Exigences Générales ».

Doc 2. Classification des indicateurs et des métriques prévus par la CSRD

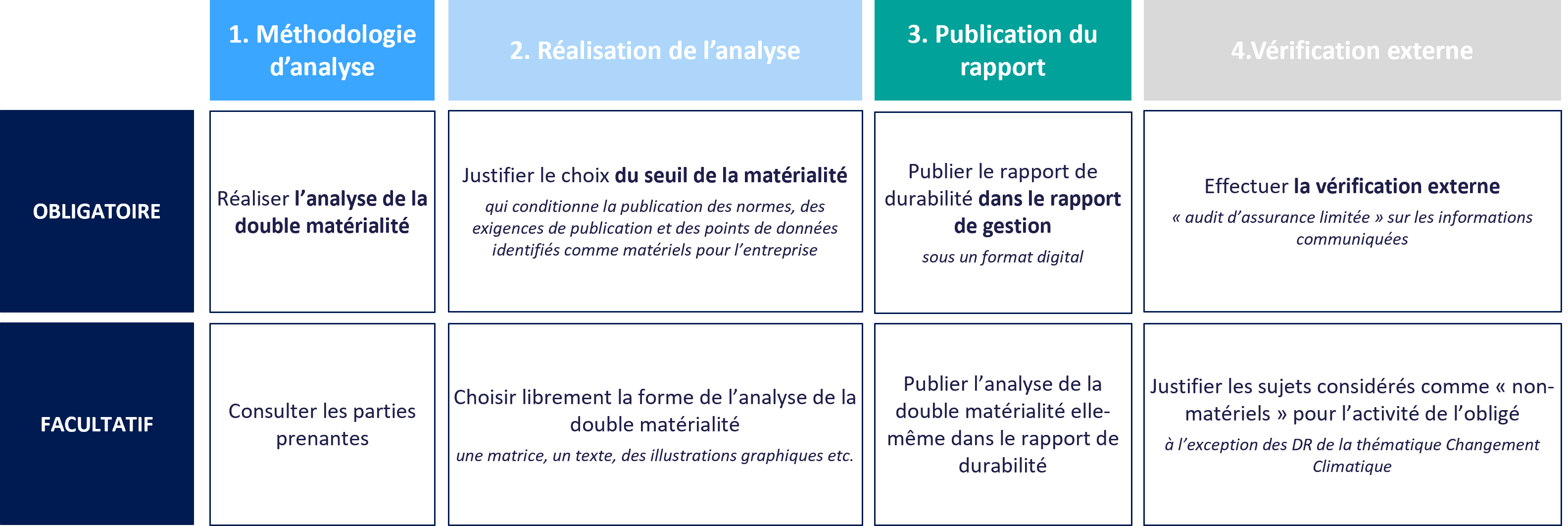

Deux temps à distinguer : le temps de l’analyse et le temps de la publication

S’agissant du temps de l’analyse, toutes les normes thématiques, les exigences de publication, et les points de données doivent faire l’objet d’une analyse de la double matérialité.

Dans le temps de la publication, des régimes distincts sont prévus pour les normes transversales (publication strictement obligatoire) et les normes thématiques. Par ailleurs, des règles en matière de charge de la preuve sont différentes pour l’application de certaines normes thématiques dont la norme relative au Changement Climatique (ESRS1, voir infra). Enfin, la CSRD prévoit des exemptions de publication, entre autres, pour la première année de reporting.

Doc 3. Régime des dispositions clés prévues par la CSRD

La réalisation du Bilan Carbone, une première étape pour la préparation du reporting extra-financier

Le régime spécifique prévu pour l’application de la norme thématique ESRS E1 Changement Climatique, soumis à un régime de charge de la preuve inversée6, met un point d’honneur à la réalisation d’un Bilan Carbone.

La réalisation d’un Bilan Carbone, déjà obligatoire en France7, devient indispensable à la justification de la matérialité ou de la non-matérialité de la thématique Changement Climatique pour l’entreprise obligée.

Réaliser un Bilan Carbone permet d’anticiper la mise en œuvre du reporting extra-financier, de quantifier l’impact de votre activité sur le climat, et d’engager les parties prenantes dans la mise en place d’une stratégie RSE.

Sources :

1 Directive (UE) 2022/2464 du Parlement Européen et du Conseil du 14 décembre 2022 en ce qui concerne la publication d’informations en matière de durabilité par les entreprises.

<https://eur-lex.europa.eu/legal- content/FR/TXT/PDF/?uri=CELEX:32022L2464>

2 L’acte délégué de la CSRD évoque une « analyse de la double importance » : « l’importance du point de vue financier » et « l’importance du point de vue de l’incidence ».

3 Il s’agit d’une avancée puisqu’auparavant, seul l’aspect financier était considéré afin de guider les choix d’investissement. La double matérialité a le même objectif.

4 Janvier 2022, EFRAG, European Sustainability Reporting, Guidelines 1 : Double materiality conceptual guidelines for standard-setting ? (version non définitive) <https://www.efrag.org/Assets/Download?assetUrl=/sites/webpublishing/SiteAssets/Appendix%202.6%20-%20WP%20on%20draft%20ESRG%201.pdf>

5 Adoptée par la Commission européenne le 31 juillet 2023, elles avaient été préparées par l’EFRAG.

6 C’est-à-dire que même dans le cas où le Changement Climatique n’est pas considéré comme « matériel » (important) pour l’entreprise, la CSRD attend de l’obligé qu’il publie « une explication détaillée des conclusions de son évaluation de l’importance au regard du changement climatique » motivant la non-matérialité.

7 La CSRD complète ainsi le dispositif français en matière d’impact sur le changement climatique. La loi française oblige les entreprises privées de plus de 500 salariés a publier tous les 4 ans un Bilan d’émissions de gaz à effet de serre (BEGES), et d’un plan de transition (Décret n° 2022-982 du 1er juillet 2022 relatif aux bilans d’émissions de gaz à effet de serre).